Key Takeaways:

- S stock (SentinelOne, Inc.) is a leading AI-powered cybersecurity company, recognized for rapid revenue growth, innovation, and volatility.

- The company’s Singularity Platform, strong analyst ratings, and expanding customer base make S stock a focus for growth-oriented investors.

- Despite ongoing net losses, SentinelOne is showing improving cash flow and gross margins, with analysts forecasting significant upside.

- The cybersecurity sector’s robust growth and recent industry disruptions position S stock as a compelling, yet high-risk, opportunity for 2025.

Introduction to S Stock

What makes S stock one of the most talked-about cybersecurity investments in 2025? As digital threats escalate and businesses race to secure their data, SentinelOne, Inc. (NYSE: S) has emerged as a key player in the AI-driven security landscape. S stock is trending among investors for its innovative technology, rapid revenue growth, and the potential for significant returns in a sector that’s both essential and ever-evolving.

This comprehensive guide to S stock will walk you through the company’s background, financials, industry context, and investment thesis. Whether you’re a seasoned investor or just starting your research, you’ll find actionable insights, data-driven analysis, and expert perspectives to help you decide if S stock deserves a place in your portfolio.

Section 1: Company Overview — SentinelOne, Inc.

1.1 Company History and Background

SentinelOne, Inc. was founded in 2013 in Tel Aviv, Israel, by Tomer Weingarten, Almog Cohen, and Ehud Shamir. The company’s mission is “to defeat every attack, every second, of every day,” reflecting its commitment to real-time, autonomous cybersecurity solutions. SentinelOne’s vision is to make cybersecurity proactive, automated, and seamlessly integrated into digital infrastructure.

Key milestones include:

- 2015: Launch of its endpoint protection platform, leveraging AI for threat detection.

- 2021: IPO on the New York Stock Exchange, raising $1.2 billion.

- 2023–2025: Strategic acquisitions (Attivo Networks, Scalyr, Krebs Stamos Group) and global expansion, cementing its leadership in AI-powered security.

SentinelOne’s growth journey is marked by innovation, rapid customer acquisition, and a focus on automating security for enterprises worldwide.

1.2 Business Model and Core Offerings

SentinelOne operates a subscription-based, software-as-a-service (SaaS) model. Its core product, the Singularity Platform, unifies endpoint, cloud, and identity security using AI and machine learning. Key offerings include:

- Singularity XDR: Cross-layer security for endpoints, cloud, and identity.

- Singularity Endpoint: AI-driven prevention, detection, and response.

- Singularity Cloud: Cloud workload protection.

- Singularity Identity: Real-time identity threat analytics.

Revenue streams are primarily recurring subscriptions, with additional income from professional services and tiered product packages. This model ensures predictable cash flow and supports ongoing innovation.

1.3 Market Position and Competitive Edge

SentinelOne is a recognized leader in endpoint security, named a Leader in the Gartner Magic Quadrant for five consecutive years. Its main competitors include CrowdStrike, Microsoft Defender, Palo Alto Networks, Sophos, and Trend Micro. SentinelOne’s unique selling points are:

- AI-driven autonomous protection

- Single agent architecture for simplified deployment

- Unified platform for endpoint, cloud, and identity security

- Strategic partnerships with Lenovo, Google Cloud, and ServiceNow

The company’s focus on innovation and operational efficiency has helped it gain traction, especially following high-profile incidents affecting competitors.

Section 2: Detailed Financial Analysis of S Stock

2.1 Key Financial Metrics at a Glance

| Metric | Value (July 2025) |

|---|---|

| Market Cap | $5.89B |

| EPS (TTM) | -$1.32 |

| PE Ratio (TTM) | -13.4 |

| Forward PE Ratio | 84.03 |

| Analyst Consensus | Buy/Moderate Buy |

| Avg. Price Target | $24.80 |

| Price Target Range | $17–$33 |

| Current Price | $17.99 |

S stock’s market capitalization stands at $5.89 billion, with a trailing twelve months (TTM) EPS of -$1.32. The negative PE ratio reflects ongoing net losses, but the forward PE ratio of 84.03 signals expected future profitability. Analyst consensus is “Buy” to “Moderate Buy,” with an average 12-month price target of $24.80, suggesting a 37.8% upside from current levels.

2.2 Growth Trajectory and Performance Trends

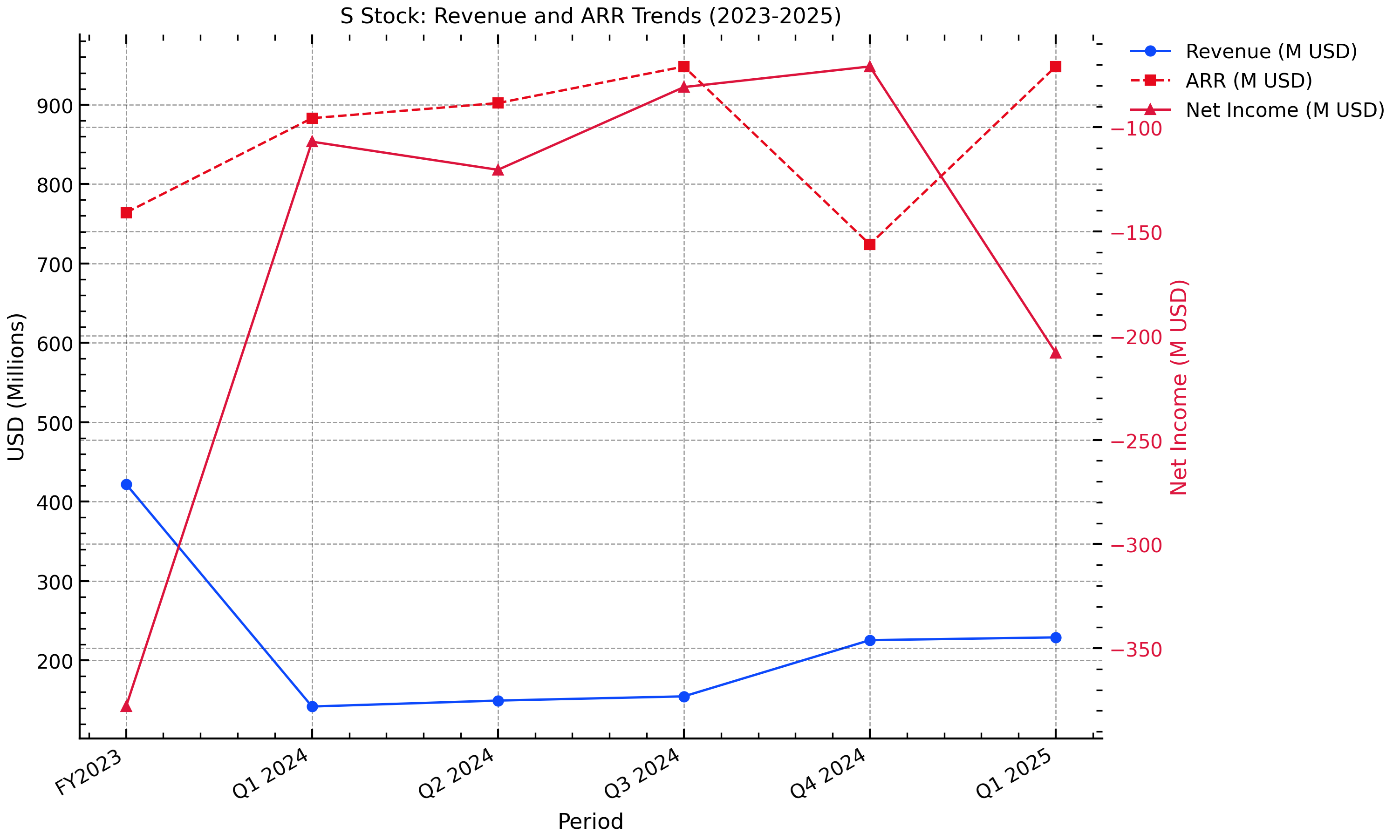

Revenue, Net Income, and ARR Trends

Figure: S Stock’s revenue and annual recurring revenue (ARR) have shown consistent growth, while net income remains negative but is improving.

Figure: S Stock’s revenue and annual recurring revenue (ARR) have shown consistent growth, while net income remains negative but is improving.

- Revenue: Grew from $422M in FY2023 to $229M in Q1 2025.

- Net Income: Remains negative, with a significant loss of -$208M in Q1 2025.

- ARR: Increased from $764M in FY2023 to $948M in Q1 2025.

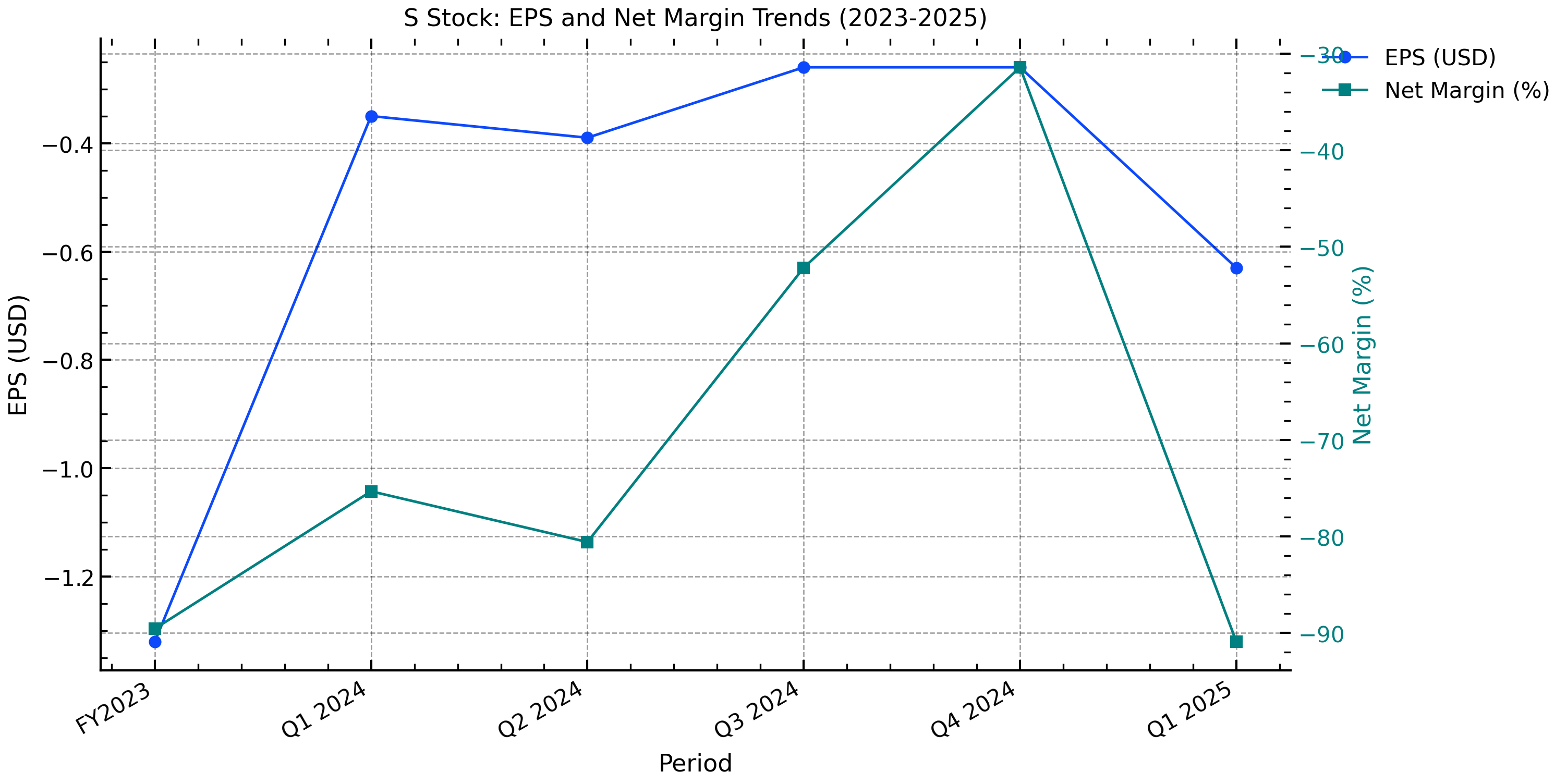

EPS and Net Margin Trends

Figure: EPS is negative but improving; net margin is trending upward, reflecting operational improvements.

Figure: EPS is negative but improving; net margin is trending upward, reflecting operational improvements.

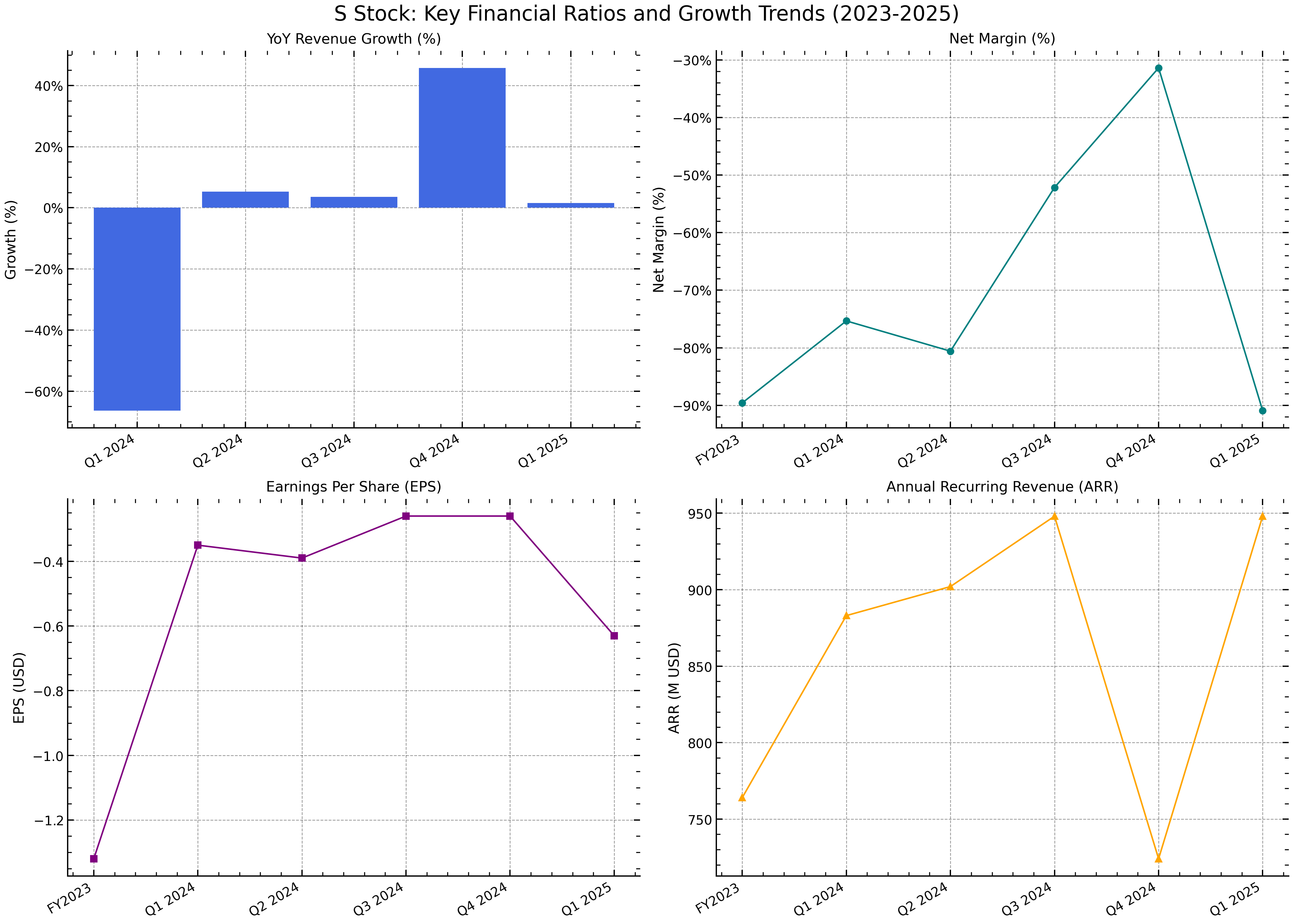

Key Financial Ratios and Growth

Figure: Revenue growth, net margin, EPS, and ARR trends highlight SentinelOne’s progress toward profitability.

Figure: Revenue growth, net margin, EPS, and ARR trends highlight SentinelOne’s progress toward profitability.

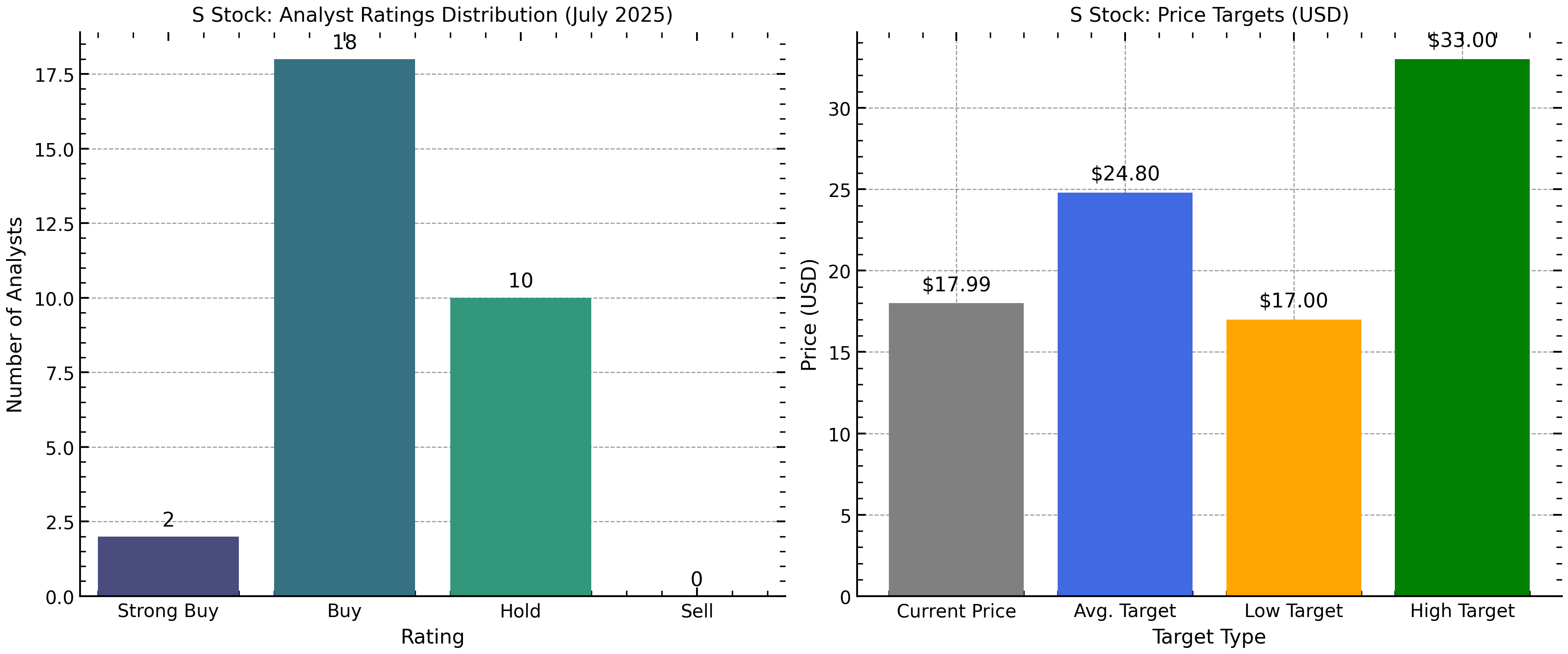

2.3 Valuation and Analyst Ratings

Analyst Ratings Distribution

Figure: Most analysts rate S stock as “Buy” or “Hold,” with no “Sell” ratings.

Figure: Most analysts rate S stock as “Buy” or “Hold,” with no “Sell” ratings.

Price Targets

- Current Price: $17.99

- Average Target: $24.80

- Low Target: $17.00

- High Target: $33.00

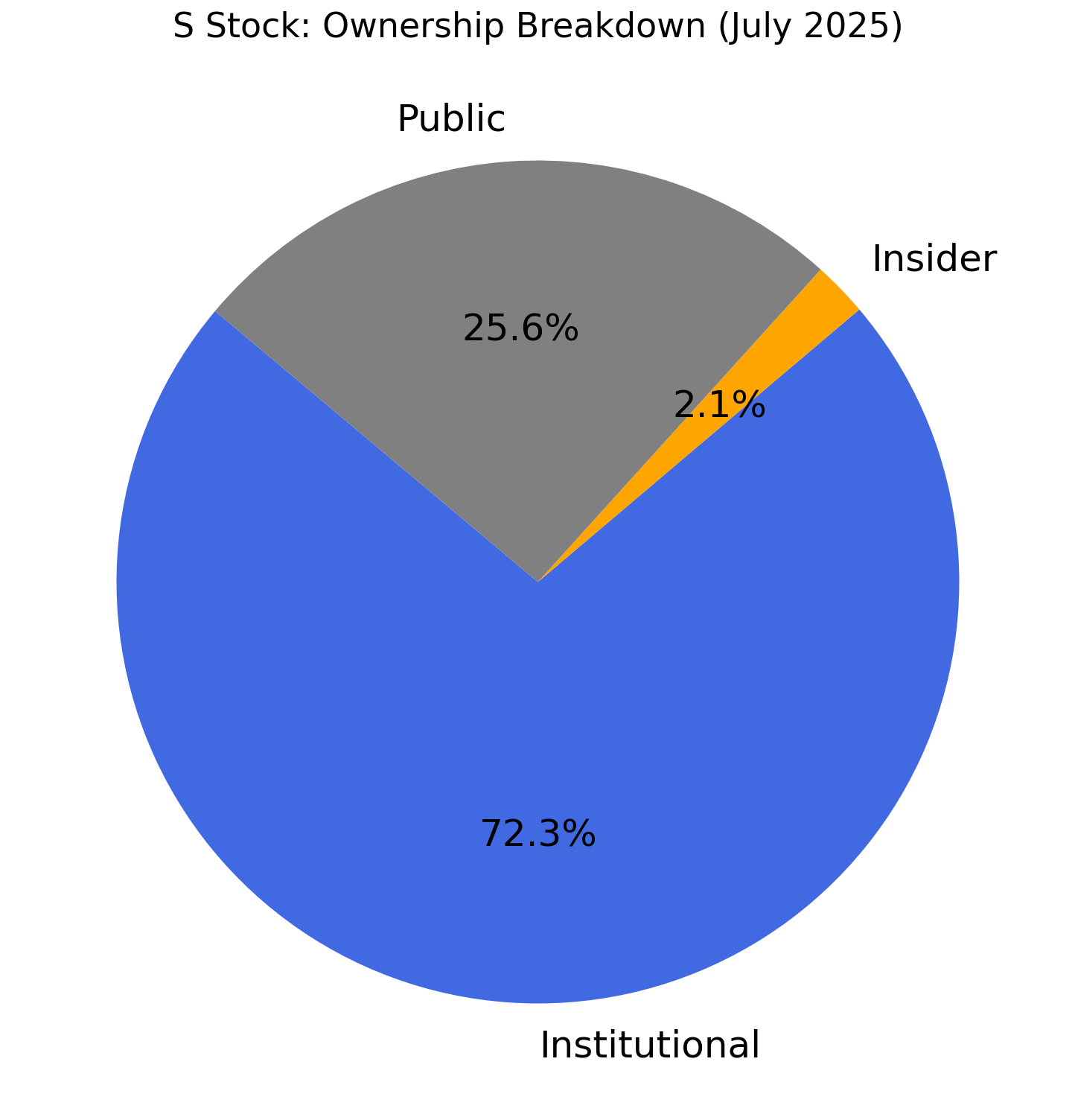

Ownership Breakdown

Figure: Institutional investors hold 72.3% of S stock, with 2.1% insider and 25.6% public ownership.

Figure: Institutional investors hold 72.3% of S stock, with 2.1% insider and 25.6% public ownership.

Section 3: How to Analyze S Stock

3.1 Methods for Stock Analysis

- Fundamental Analysis: Examines financial health, intrinsic value, and management effectiveness.

- Technical Analysis: Uses price charts, trading volume, and technical indicators to identify trends.

- Quantitative and Sentiment Analysis: Leverages data and market sentiment to gauge investor mood.

3.2 Conducting a Fundamental Analysis of S Stock

- Balance Sheets: Assess cash reserves, debt, and asset quality.

- Income Statements: Track revenue, net income, and margins.

- Cash Flows: Monitor free cash flow trends and operational efficiency.

- Management Effectiveness: Evaluate leadership, governance, and strategic vision.

3.3 Technical Analysis: S Stock in Focus

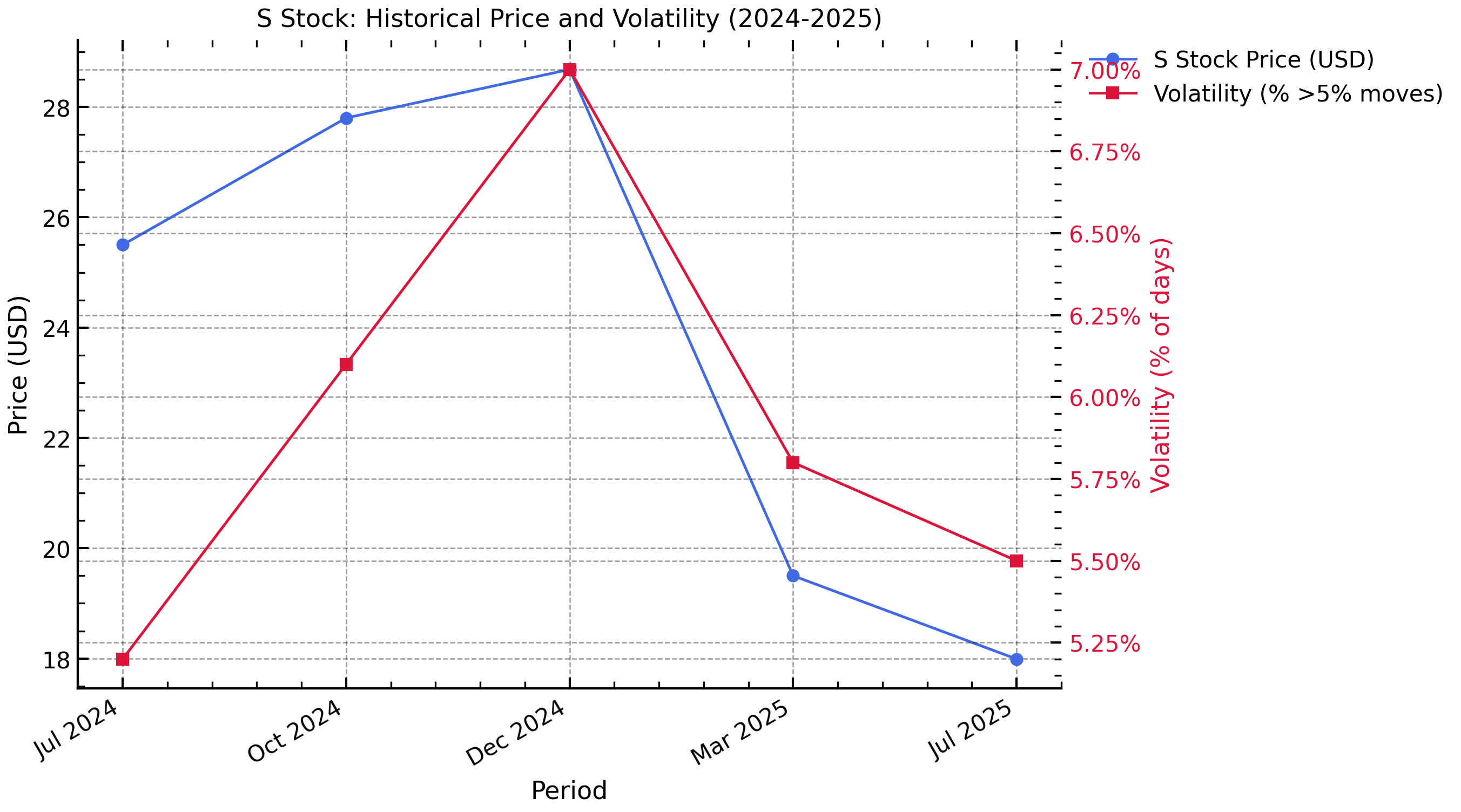

- Price and Volatility Trends

Figure: S stock has experienced significant price swings and volatility, with 21 moves greater than 5% in the past year.

Figure: S stock has experienced significant price swings and volatility, with 21 moves greater than 5% in the past year.

- Popular Indicators: Moving averages, RSI, MACD, and volume spikes.

3.4 Sentiment and News Analysis

- News Impact: Analyst upgrades, earnings beats, and industry events can drive sharp price movements.

- Earnings Reports: Positive free cash flow and revenue growth have recently boosted sentiment.

- Market Mood: S stock is considered undervalued by some analysts, trading at a 40% discount to peers.

Section 4: Industry and Market Environment

4.1 Cybersecurity Sector Overview

The cybersecurity industry is booming, driven by:

- Escalating cyber threats and ransomware attacks

- AI and machine learning integration for threat detection

- Cloud security and XDR adoption

- Regulatory pressures and privacy concerns

SentinelOne’s focus on AI-powered, autonomous protection positions it well in this high-growth sector.

4.2 Comparative Analysis: S Stock vs. Industry Peers

| Company | Market Cap (B) | Revenue Growth | Profitability | AI/Cloud Focus | Analyst Rating |

|---|---|---|---|---|---|

| SentinelOne (S) | $5.89 | 22.9% (Q1 2025) | Negative | High | Buy |

| CrowdStrike | $60+ | 30%+ | Positive | High | Buy |

| Palo Alto NW | $100+ | 20%+ | Positive | High | Buy |

| Microsoft | $3T+ | 10%+ | Positive | High | Buy |

SentinelOne is smaller but growing rapidly, with a strong AI and cloud focus. Its profitability lags behind larger peers, but its innovation and recent customer wins are closing the gap.

Section 5: Investment Thesis — Is S Stock a Good Buy?

5.1 Bull Case: Why Invest in S Stock?

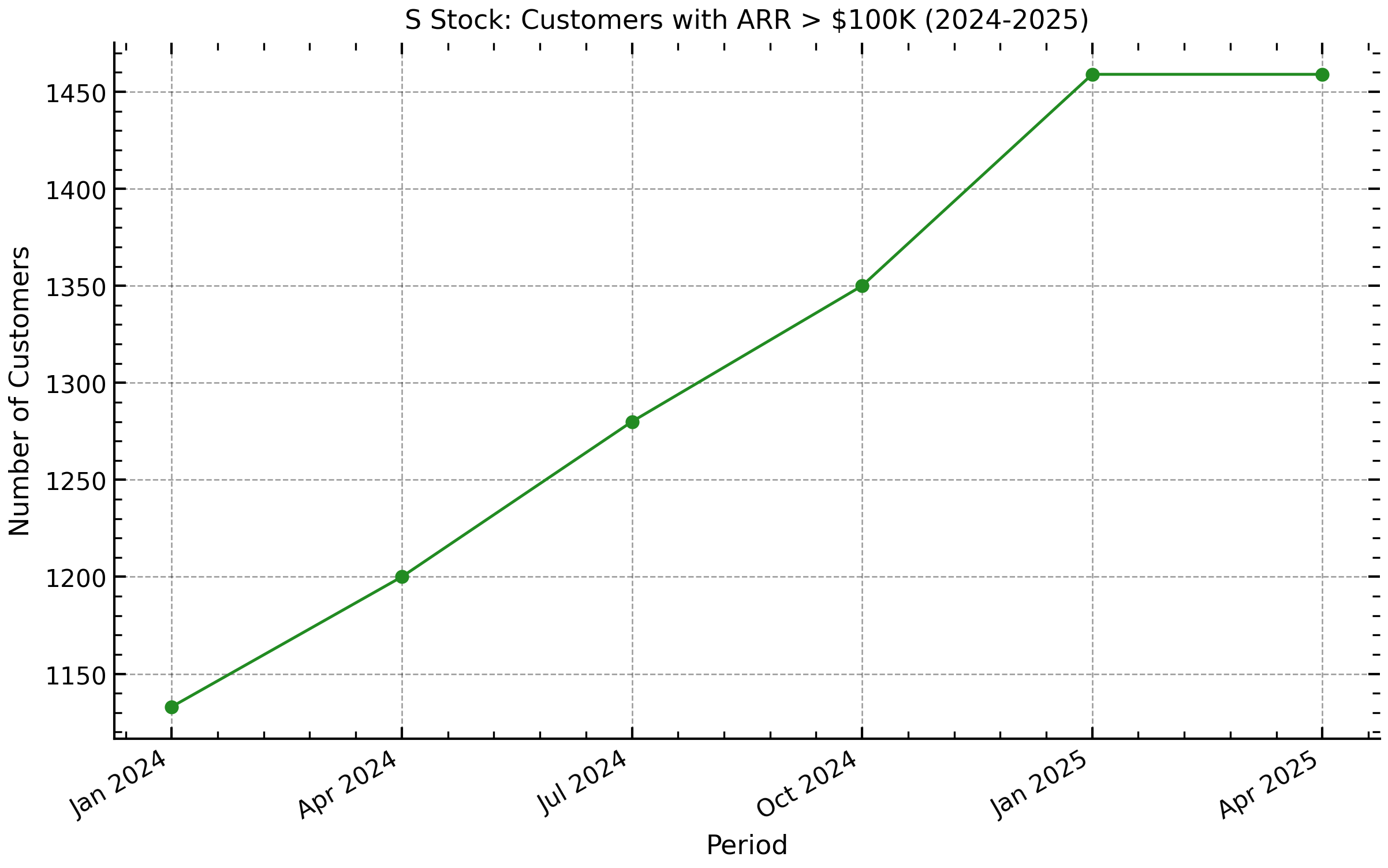

- Growth Story: Revenue and ARR are rising, with a growing base of high-value customers.

- Technological Edge: AI-driven, autonomous security is a major differentiator.

- Analyst Optimism: Most analysts rate S stock as “Buy,” with price targets suggesting 30–40% upside.

- Industry Tailwinds: The cybersecurity sector is expanding, and SentinelOne is gaining share, especially after competitors’ missteps.

5.2 Bear Case: Risks and Challenges

- Volatility: S stock is highly volatile, with frequent price swings.

- Profitability: Net losses remain significant, though cash flow is improving.

- Competition: Faces intense competition from larger, established players.

- Regulatory and Tech Risks: Evolving threats and compliance requirements could impact growth.

5.3 Key Catalysts for Future Growth

- Cloud Security Expansion: New integrations with AWS and cloud-native protection.

- AI Innovation: Launch of Purple AI and Singularity AI SIEM.

- Customer Wins: Record growth in customers with ARR > $100K.

Figure: High-value customer growth is a key driver for recurring revenue.

Figure: High-value customer growth is a key driver for recurring revenue.

Section 6: How to Buy S Stock

6.1 Setting Up to Invest

- Choose a Broker: Select a reputable trading platform (e.g., Fidelity, Schwab, Robinhood).

- Understand Order Types: Market, limit, and stop-loss orders help manage risk.

6.2 Step-by-Step Guide: Buying S Stock

- Open and Fund Your Account: Complete registration and deposit funds.

- Research S Stock: Review financials, analyst ratings, and news.

- Place Your Order: Enter S stock’s ticker (S), select order type, and confirm your trade.

6.3 Portfolio Management Tips for S Stock Owners

- Diversify: Don’t over-concentrate in one sector.

- Monitor Performance: Track earnings, news, and analyst updates.

- Rebalance: Adjust your holdings as your investment goals evolve.

Section 7: Frequently Asked Questions (FAQ) About S Stock

What affects S stock’s price the most?

Earnings reports, analyst upgrades/downgrades, industry news, and major cybersecurity incidents.

Is S stock suitable for long-term investors?

It’s best suited for growth-oriented investors comfortable with volatility and a long-term horizon.

How is S stock rated by major analysts?

Most analysts rate S stock as “Buy” or “Moderate Buy,” with no “Sell” ratings and a consensus price target of $24.80.

Does SentinelOne pay dividends on S stock?

No, SentinelOne does not currently pay dividends, reinvesting profits into growth and innovation.

Where to track real-time S stock news and data?

Major financial news sites (Yahoo Finance, CNBC, Barron’s) and SentinelOne’s investor relations page.

How to access SentinelOne investor relations resources?

Visit the company’s official website and navigate to the “Investors” section for reports, presentations, and updates.

Section 8: Expert Opinions and Analyst Insights

- Rosenblatt Securities (July 2025): Initiated “Buy” with a $24 target, citing undervaluation and strong free cash flow.

- BofA, JP Morgan, Wells Fargo (May 2025): Downgraded due to profitability concerns, but acknowledged SentinelOne’s innovation.

- Consensus: S stock is volatile but offers significant upside if profitability improves and market share expands.

Section 9: Latest News and Market Updates

- July 2025: S stock rose after Rosenblatt’s “Buy” rating and $24 target.

- Q1 2025 Earnings: Revenue up 22.9% YoY, positive free cash flow margin of 18%, but net loss widened to -$208M.

- Industry Disruption: SentinelOne gained momentum after a major operational failure at CrowdStrike, with customers considering migration.

Conclusion: Should You Consider S Stock in 2025?

S stock (SentinelOne, Inc.) stands at the intersection of innovation and necessity in the cybersecurity world. The company’s AI-powered platform, rapid revenue growth, and expanding customer base make it a compelling choice for investors seeking exposure to a high-growth sector. While ongoing net losses and volatility present risks, improving cash flow and strong analyst support suggest a path to profitability.

If you’re comfortable with risk and believe in the future of AI-driven security, S stock could be a valuable addition to your portfolio. As always, conduct your own research, diversify your holdings, and consult with a financial advisor before investing.

Ready to dive deeper into S stock? Start your research today, review the latest earnings reports, and join the conversation in the comments below. For more insights on cybersecurity investing and market trends, explore our related articles and resources.

For more, visit our website, S-Ornery home.com